Gurpreet Singh Sahi stated in a note on Thursday that “the market is missing an expected improvement in net interest margins.” Because the lender’s shares have not responded to the higher rates. Nevertheless, they continued that given their first-quarter margin miss, delivery from banks is crucial.

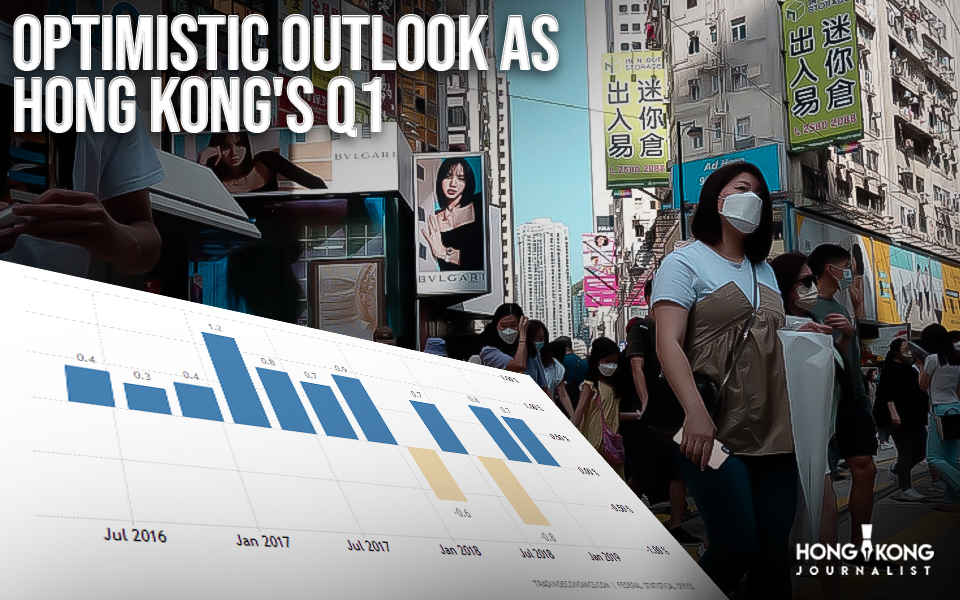

Following the city’s frequent currency interventions to boost the local dollar, the overnight Hong Kong interbank offered rate, or Hibor, shot up to a 16-year high on Thursday. However, a day later, the borrowing costs throughout the curve started to decline. After rising for 16 straight days, the one-month Hibor, the primary benchmark for the city’s mortgage rate, dropped 19 basis points to 4.34% on Friday, while the overnight rate slipped 26 basis points to 4.54%.

Local banks have raised the major lending rates they offer to customers as a result of the recent hike in Hibor. The largest lender in the city, HSBC Holdings Plc, raised its prime rate on Hong Kong dollars earlier this month to 5.75% annually. Additionally, Bank of China (Hong Kong) and Standard Chartered Plc stated they will increase their prime rates.

Some local lenders’ stocks, like those of BOC Hong Kong Holdings Ltd. and Hang Seng Bank Ltd., have seen declines in value from recent highs, outperforming declines in the benchmark Hang Seng index as a whole.

The analysts stated in the report that Goldman maintains their buy ratings on HSBC Holdings Plc and BOC HK, with price targets implying more than 30% upside from present levels.

- Published By Team Hongkong Journalist