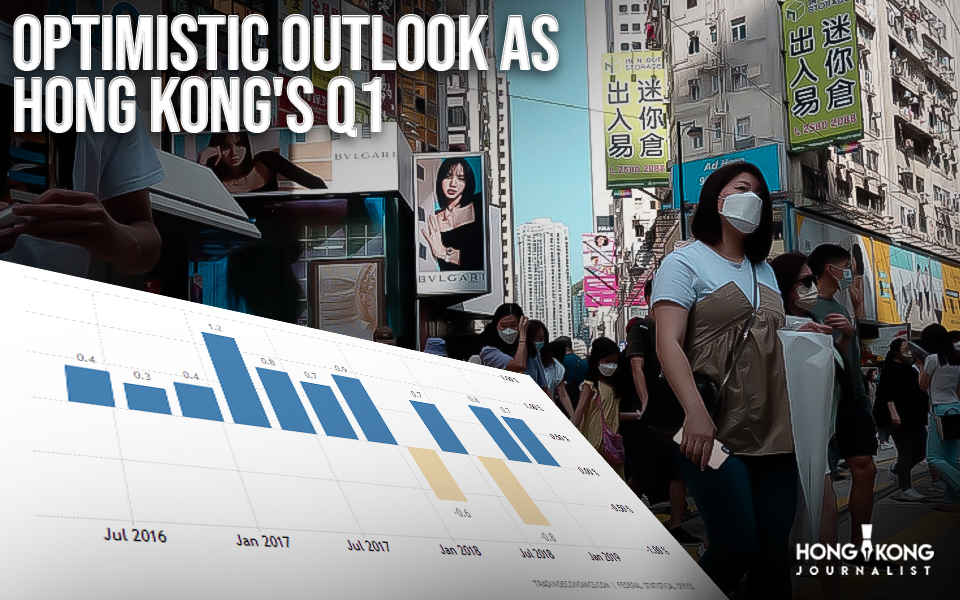

On Thursday, Hong Kong Monetary Authority (HKMA) enhanced its base rate charge, the overnight discount window, by 25 basis points to 5.0%. Hong Kong’s monetary policy is moving in lockstep with the United States. The city’s currency is pegged to the greenback in a tight range of 7.75%-7.85%.

“Rate hikes in the U.S. will not affect the financial and monetary stability of Hong Kong,” HKMA chief executive Eddie Yue told a media source, adding that monetary and financial markets continue to operate in a smooth and orderly manner.

While announcing the latest policy decision, the US central bank scaled back to a quarter percentage point rate increase after a year of huge hikes and Fed chairperson Jerome Powell suggested a “couple” more hikes are waiting ahead.

“The rate hike cycle in the U.S. has not yet been completed, the Hong Kong dollar interbank rates might remain at elevated levels for some time,” Yue said.

However, the HSBC lending rate is saying a different story. The HSBC holdings are currently at 0005. HK is unchanged at 5.625%, despite a raise by the city’s de facto central bank.

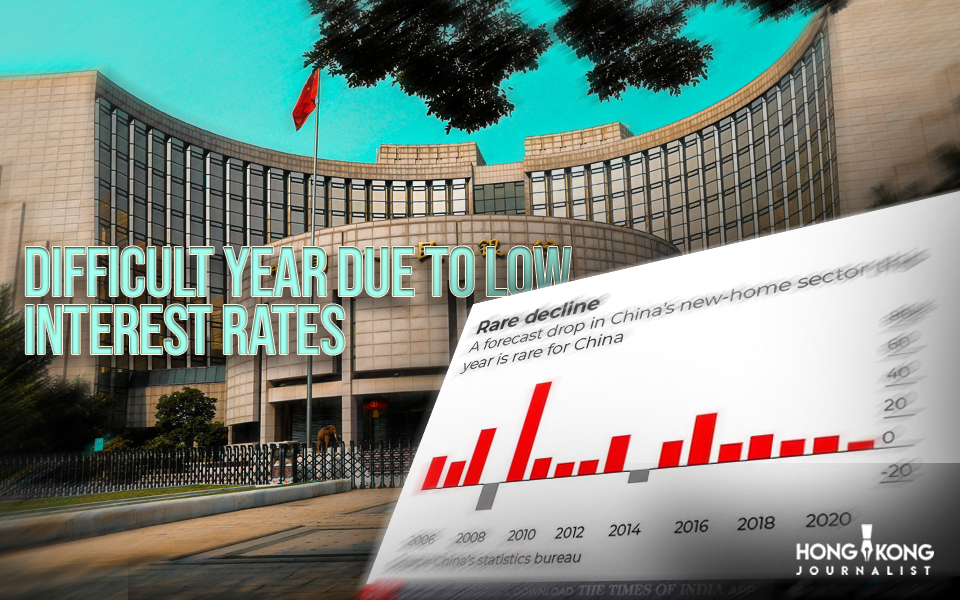

Hong Kong is in extreme danger because of high inflationary pressure and aggressive monetary tightening in advanced economies. Higher borrowing costs and a pessimistic economic outlook have hit asset prices, dragging 2022 private home prices down by 15.6% in the first annual drop since 2008.

The residential loan mortgage loans jumped nearly 22-fold in Q4 from the previous one.

- Published By Team Hongkong Journalist