Morgan Stanley, an American multinational investment banking company, is planning to lay off its 7% of workforce in the Asia-Pacific region. There could be around 40 jobs, according to a source with direct knowledge on the matter.

The cuts will impact investment banking and capital market firms around the region, but not in Japan.

However, a spokesperson from Morgan Stanley is maintaining silence. When asked about the matter, he avoids commenting on this issue because it is confidential.

Job cuts are a major part of global reduction as a result of market conditions and minimizing expenses, the source said.

This investment bank is trying to target 3000 job cuts globally in the second quarter, in its second round of layoffs in six months, as reported by Reuters on May 1st.

Sources say the slow dealmaking and tough economic environment make the investment banks look forward to their staffing.

Morgan Stanley had more than 82,000 employees at the end of March, so cutting 3,000 jobs would represent a reduction in staff by nearly 4%.

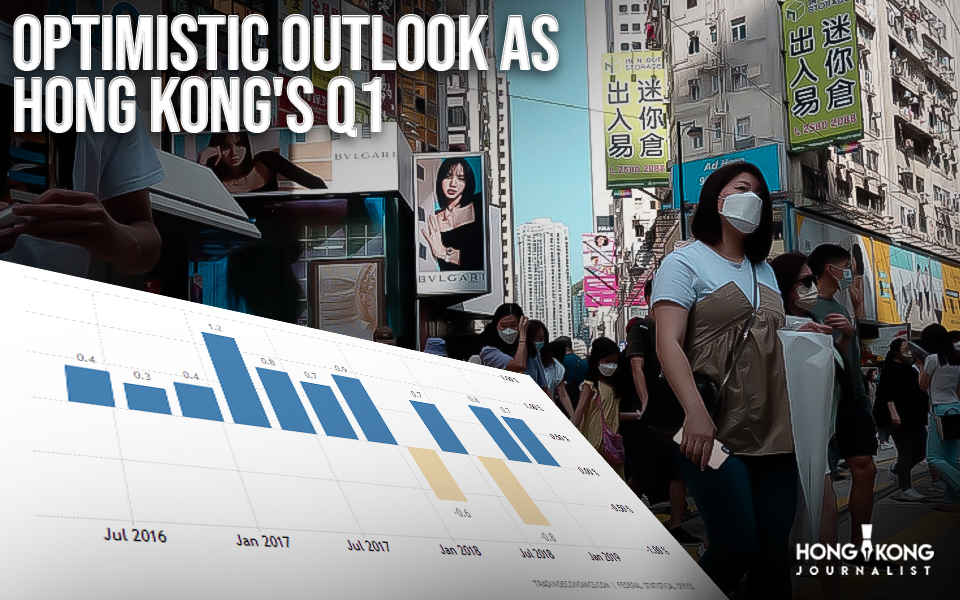

Global dealmaking has dropped dramatically as well as corporate buyout activities are also suffering after a decade, in the very first quarter of 2023.

In Asia, the value of deals involving the region’s companies totaled $176 billion in the first quarter of 2023, 34% less than a year earlier and the lowest level since 2013, Refinitiv data shows.

Capital market activities are also tremendously declining. According to advisors, it is also being noticed that Hong Kong’s initial public offerings (IPO) are looking weak for the rest of the year.

- Published By Team Hongkong Journalist