In This Article:

The World Bank is known to have furnished $350 million in insurance-linked securities (ILS) in the format of Chile Catastrophe Bond in the Hong Kong Special Administrative Region (HKSAR) on Tuesday. It marked the initial listing of ILS in Hong Kong, and its 4th ILS issuance in total.

All this occurred while the city continued to leverage its standing as the “super connector” between the Chinese mainland and the rest of the world. The goal is to attract international investors.

The Chile Catastrophe Bond is the largest of its kind for a country led by the World Bank. They offer support against losses pertaining to earthquake risks in Chile over the next 3 years.

The $350 million catastrophe bond is part of a $630 million aggregate earthquake risk coverage transaction for Chile. This also incorporates $280 million of catastrophe swaps.

According to a statement on the HKSAR Government website, the Hong Kong Financial Secretary (Paul Chan ) mentioned that the move is proof of the nation’s position as an international financial center and the spirited development of the Hong Kong insurance industry.

Liu Guohong, director of Department of Finance and Modern Industries at China Development Institute in Shenzhen, Guangdong Province, informed the Global Times-

“The catastrophe bond targets a niche market, and only professional investors are able to access it. So the successful listing underscores the global influence of Hong Kong’s financial markets and the diverse products offered by its vibrant capital market.”

The Chairman of Hong Kong Insurance Authority (IA) Stephen Yiu was quoted as saying in the statement-

“The decision by a prominent international body like the World Bank is a milestone in the city’s journey of striving to become a vibrant ILS hub, while enhancing public awareness of how alternative risk transfer tools could supplement underwriting capacity to increase financial inclusiveness and close protection gaps.”

A ceremony at the Hong Kong Exchanges and Clearing was convened in the presence of representatives from the HKSAR government, the IA, and the World Bank.

According to a press release, the Vice President and Treasurer of the World Bank conveyed that the financial institution is “proud to have partnered with HKIA and the Hong Kong Stock Exchange on this transaction that was very well-received by both the capital markets and the reinsurance market.”

Liu predicted that white-collar investors and the state-backed funds in the mainland would be the major participants in the purchase of bonds.

It also exhibited Hong Kong’s distinctive bridging role, as the city has sought to be a facilitator in the national “dual circulation” strategy. The way this happens is by enhancing connectivity with the Chinese mainland and the international markets, as per Hong Kong financial officials.

In the year 2021, Hong Kong executed a streamlined regulatory regime and activated a pilot grant program, which set course for ILS issuance and listing.

Chan mentioned that the HKSAR government is willing to support the Hong Kong insurance sector in offering a expansive variety of extensive products and solutions to “assist our country and global market players for better management of relevant risks.”

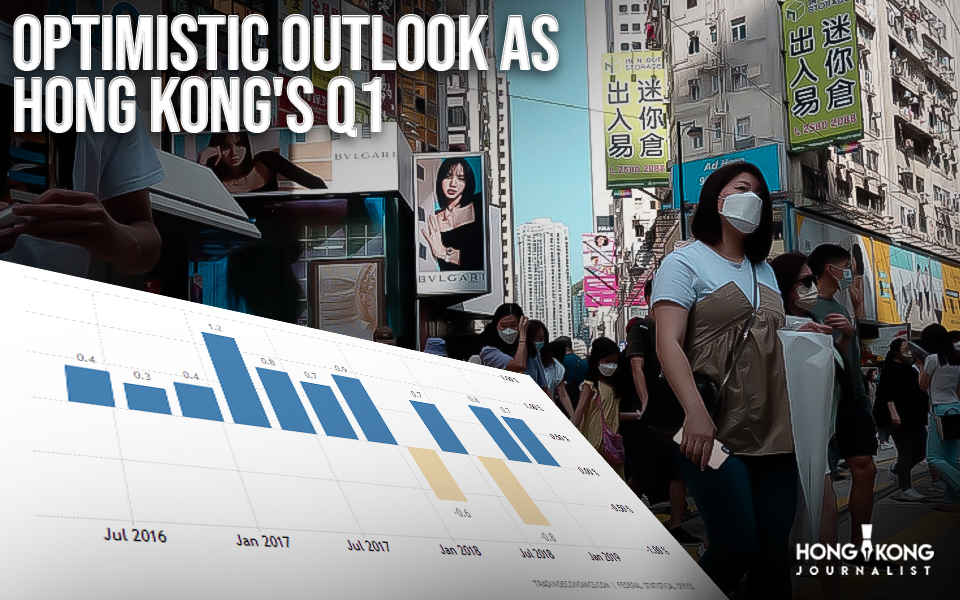

The city’s role as a global financial hub and an asset “safe haven” has been in the global limelight in recent days, amid a snowballing confidence collapse toward the Western banking and financial systems. This was after the turmoil involving Credit Suisse, Silicon Valley Bank, and other US banks.

Media reports cited the Hong Kong Secretary for Financial Services and the Treasury Christopher Hui the following:

On Friday, Hong Kong had announced programmes to attract wealthy family offices in setting up in the financial hub. It is hoped that through various measures, at least 200 family offices would be attracted to Hong Kong by 2025.

- Published By Team Hongkong Journalist