As the Covid-19 restrictions were lifted and sell-offs last year made stocks more appealing, China’s largest fund manager flocked to consumer stocks.

Tencent Holdings, liquor producers Wuliangye Yibin and Kweichow Moutai, and dairy manufacturer Inner Mongolia Yili Industrial Group were among Zhang Kun’s top 10 holdings as of the end of 2022, according to the annual report of his flagship fund, the US$8.3 billion E Fund Blue Chip Selected Mixed Fund, which was managed by Zhang Kun.

When managing four funds with a combined US$13.1 billion in assets for Guangzhou-based E Fund Management, Zhang holds the title of the largest asset manager in China’s 27 trillion yuan (US$3.9 trillion) mutual fund market.

His preference for consumer bets aligns with the government’s priority of household consumption this year, which has seen local governments in Beijing and Shanghai unveil consumption-boosting packages this month, including subsidies for the purchase of electric vehicles and green appliances.

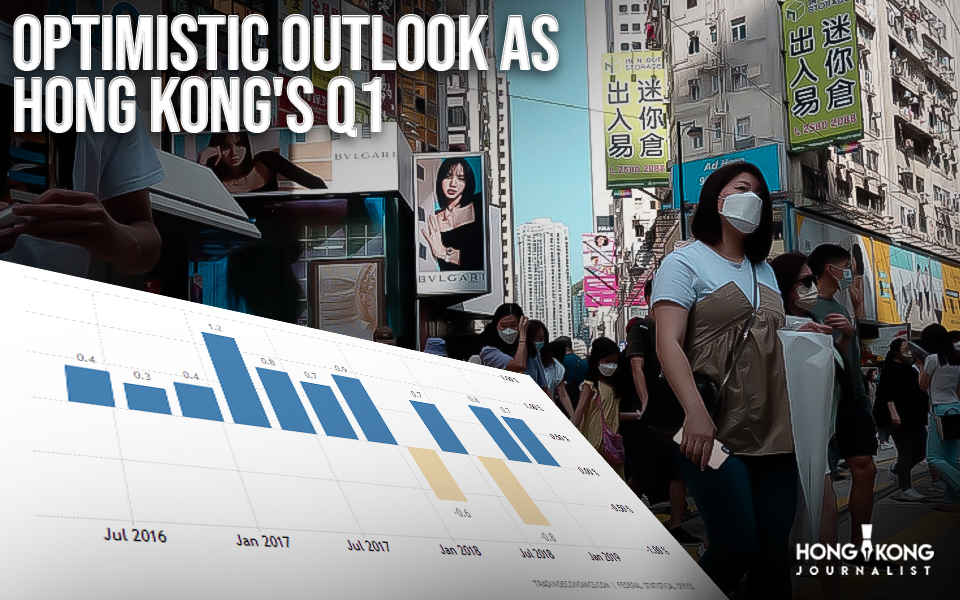

A sub-index of consumer-stuff stocks, including Kweichow Moutai and Yili, has risen nearly 30% since an October low, making it the CSI 300 Index’s second-strongest industry group.

An analyst at China Merchants Bank in Shenzhen, Tan Zhuo, stated that “Consumption is expected to recover to the pre-pandemic level as we have seen a mild recovery in household incomes, an improvement in the job market, reopening, and all the consumption-boosting measures.”

The banks predict annual retail sales to surge by 9%, jumping to a 3.5% increase in the January-February period.

Last year, E Fund Management’s blue-chip fund lost 16% of its value, outperforming the CSI 300’s 22% loss. Zhang attributed the outperformance to his focus on companies that can deliver long-term earnings growth.

“The stock market suffered from bouts of swings and declines in 2022,” Zhang said in the annual report. “For each significant market decline, stocks are up for ‘discount sales’. It’s not a good option to refrain from buying into a company with long-term profitability, or even sell it, simply because of worries about the change of the economic situation in the short term or hedges against market fluctuations.”

According to the report, Zhang’s stock pick criteria include a company’s per-share earnings and free cash flow growth, as well as its “moat,” an industry term referring to the competitive advantage it has to fend off rivals.

As per the calculation by the Post, Zhang in the fourth quarter made small changes to his portfolio by buying 210,000 shares of Kweichow Moutai and selling 1.1 million Tencent shares

So far this year, the blue-chip fund’s net asset value has increased by 0.7%, trailing the CSI 300 index’s gain of 4.3%.

- Published By Team Hongkong Journalist