Attending the fund’s annual general meeting last week in London were the investment trust Fidelity Asian Values’ board and investment managers.

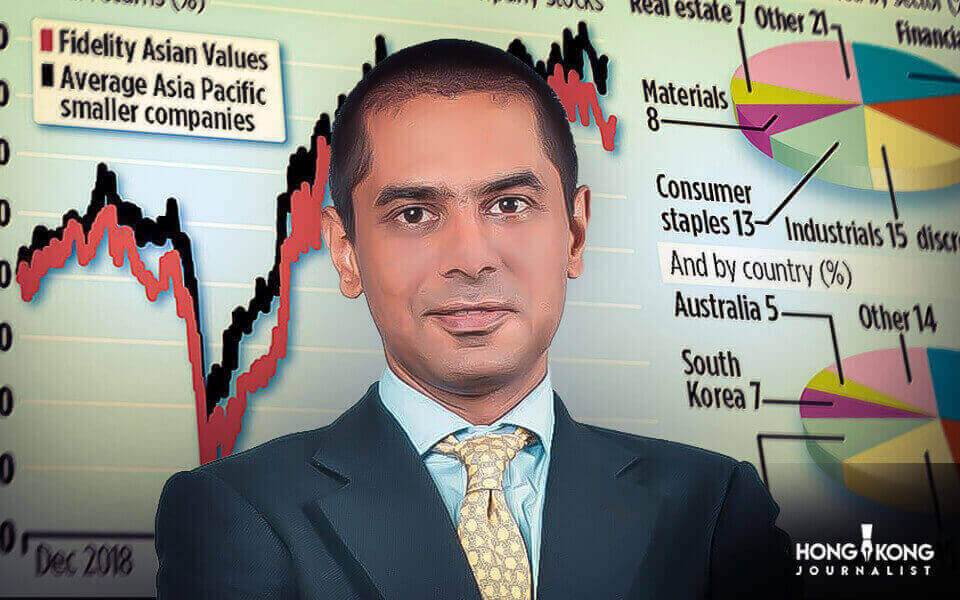

Lead manager Nitin Bajaj, who works out of Singapore, was feeling upbeat as he thought back on the previous year and the one that lay ahead. During the most recent fiscal year, which ended at the end of July, the trust increased its dividend payments and gave stockholders double-digit total returns.

A bright future lies ahead, particularly if a rebound in the world stock market prompts a revaluation of smaller businesses, which is the focus of the £344 million trust’s investments in Asian markets.

The trust, founded 27 years ago, makes investments in tiny businesses on all Asian stock exchanges, excluding Japan. Its largest holdings are in China, and it owns more than 150 listed stocks.

Catherine Yeung is the investment director for Asian Equities at Fidelity and also serves as the investment director for the trust. She was in the UK for the AGM, just like Bajaj, and returned to her home base of Hong Kong last Thursday.

The universe of trusts, she claims, is full of investment opportunities. These trusts are listed companies whose market capitalisations range from less than £1 billion to more than £10 billion.

“Smaller companies in Asia are under-researched,” she continues. If you’re willing to put in a lot of effort, network with local businesses, and form connections, you may make amazing profits. At Fidelity, that is what we do.

We have fund managers situated in Singapore and Hong Kong as well as research analysts searching for investment opportunities around the region.

Yeung’s argument is supported by the most recent performance data, which was supplied by financial data provider Trustnet. The trust has produced a 6.5% return over the last 12 months. Over the previous ten years, the annualised returns on average is 10.4%.

Even though many UK investors still have strong anti-Chinese sentiments, Yeung claims that many Chinese businesses are behaving morally by strengthening their corporate governance and giving dividends to shareholders.

She says, “China plays a big part in our overall investment thesis.” When I visited last month, a lot of the smaller businesses had adjusted to the Chinese government’s new regulations. While we do take geopolitical factors into account, our main goal is to find competitive prices on well-run companies managed by decent people.

Stakes in gold jewellery merchant Chow Sang Sang and pork supplier WH Group are among the trust’s top 10 holdings. Hong Kong lists both of them. One of the trust’s main industry themes is finance, and it has significant holdings in the Indonesian banks Bank Negara and Bank Mandiri as well as the Indian banks Axis and HDFC.

According to Yeung, “access to banking and credit is a compelling long-term story across the region.” “Demographic shifts and the rise of a middle class with disposable income are driving it.”

The dividend paid out by Fidelity Asian Values is less than three percent annually. With the exception of two years (2014) and 2020, payments have increased during the last ten years. The shares are currently selling at about £4.90, and the payment made in the previous fiscal year was 14.5p per share. Its ticker is FAS, and its stock exchange ID code is 0332231. The total annual charge is 0.96 percent.

In a related development, Fidelity will solidify its standing as a top global investor in Asia and China with the declaration that, subject to shareholder approval, the assets of competitor trust Abrdn China Investment Company will be absorbed into its China Special Situations trust. Should the deal go, it will establish a trust that will be tasked with overseeing £1.2 billion.

- Published By Team Hongkong Journalist