KEY POINTS:

- China’s economy was at a slower pace last quarter as a result of a surge in Covid risks in December, causing disrupted activity and affecting the authorities’ removed mobility curbs.

- The Hang Seng Index had railed up to 48% from its low on October 31 parking its technical buy-sell indicator in an overbought zone.

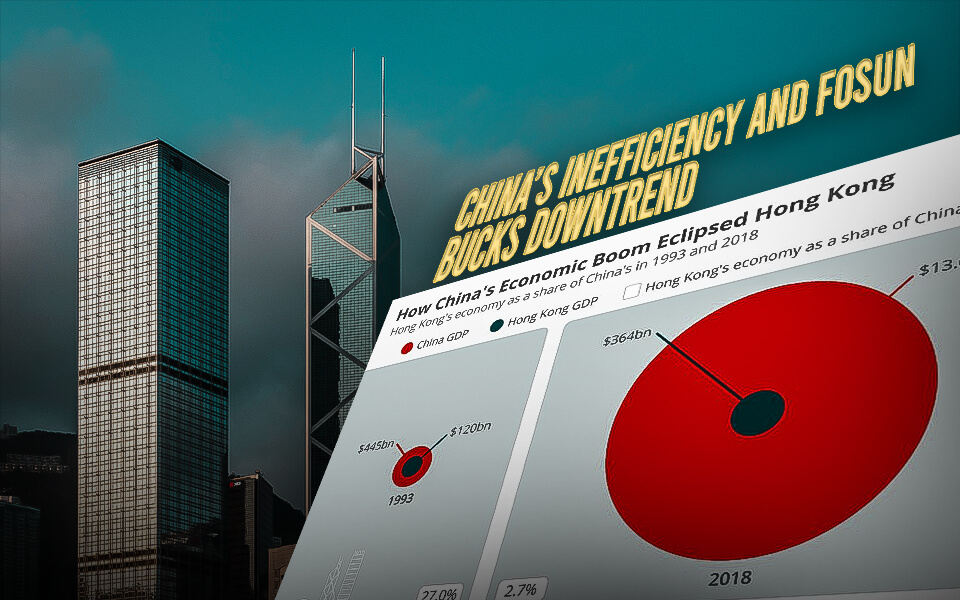

According to new reports, Hong Kong’s economy is in trouble with a 6 month high risk factor. It has been declared that China’s economic position is terrible after the COVID impact and infections that spread out in December. The market became overheated, and China has informed its investors about cutting out their holdings.

Yesterday, Hang Seng was reported to touch 21818. Sixty-five points dropped by 1% during the local noon trading break, bringing it down to 21,527. 39. It affected the shares of the Tech Index, which lost 0.6%, and Shanghai Composite Index which sank by 0.3%.

E-commerce platforms have faced the issue because of economic imbalances.

| Company Name | Drop Down (%) | Value in HK$ |

|---|---|---|

| JD.com | 3% | 236.60 |

| Baidu (Search Engine Operator) | 2.7% | 130.70 |

| Tencent | 0.8% | 367.20 |

| Sands China (Macau Casino Operator) | 3% | 27.90 |

| WuXi Biologics | 5.4% | 69.90 |

The Static Bureau said that in last year’s fourth quarter, the economy of China grew by 2.9%, which is benefiting them this year when the economy is suffering from a margin of 3.9% in the preceding three months. Therefore, they added the full-year growth of 3% vs. 8.1% in 2011.

“This declaration shows the pressure of uncertainties associated with Covid,” said Zhu Chaoping. “On the other hand, risks persist in the property sector and local government debt. Therefore, accommodative policies should also remain in place to support business confidence.”

Some government reports provided that retail sales fell by 1.8% from a year earlier, following a 5.9% decline in November. On the other hand, industrial output increased by 1.3% versus a 2.2% gain in November.

Resisting the trend, Fosun International added 2.8% to HK $7.34. The Chinese conglomerate’s domestic onshore unit obtained 12 billion yuan (US$1.8 billion) in syndicated loans from eight Chinese banks. As a result, it has been suggested that its liquidity problem has improved.

On Tuesday, two companies started trading in Hong Kong. Sanergy Group jumped 18 percent to HK$1.88, while property management firm Runhua Living Service Group tumbled 21 percent to HK$1.35.

- Published By Team Hongkong Journalist