Stock Market, Banking Sector, and Foreign Direct Investment

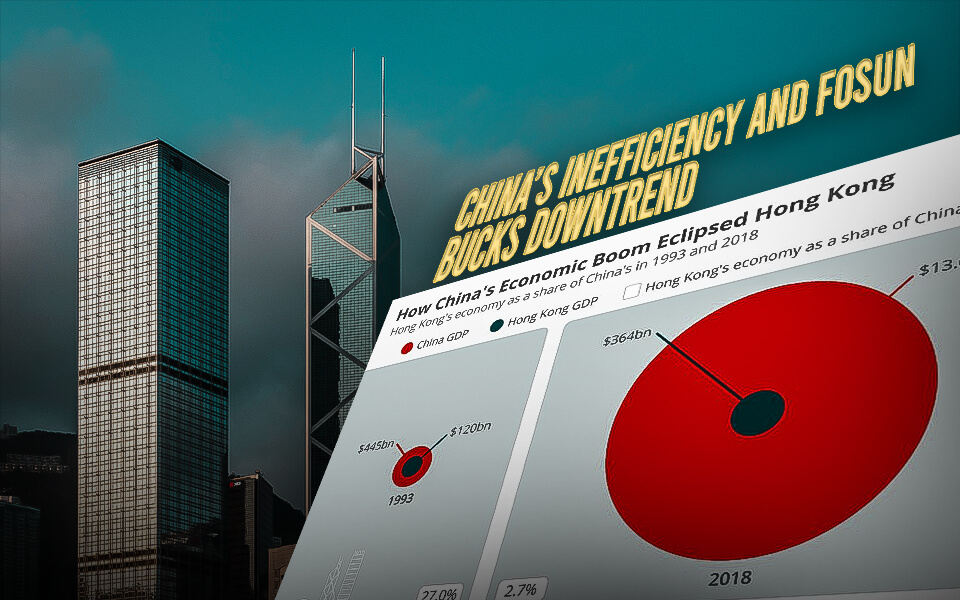

Hong Kong has been improving for the last two weeks, still some of its areas are in the developing zone. However it is weakened by its Global Financial Status and is trying hard to come back. If we look back at 2020, the banking sector’s two main factors i.e. customer deposit and foreign currency reserves hit record highs in Hong Kong.

Specifically, customer deposits increased by 5.4 percent to HK$14.5 trillion (about US$1.9 trillion), while foreign currency reserves soared by 11.5 percent to about US$492 billion.

The 2020 economic impact occurred because of the political disturbances in 2019 and COVID-19, although the recovery is much more impressive.

Regarding the city’s stock market, the total market capitalization of companies listed on the Hong Kong Stock Exchange expanded considerably by 24.5 percent in 2020, amounting to a record high of HK$47.5 trillion (about US$6.2 trillion).

This was reinforced by a flow in fundraising activities during the same year, with data showing that the number of funds raised from IPOs on Hong Kong’s Main Board increased by 27.6 percent to about HK$400 billion (about US$52 billion), ranking second globally in 2020.

Meanwhile, trading in Hong Kong’s stock market was also very active, as the average daily turnover in the securities market rose by 48.6 percent to HK$129.5 billion (about US$16.8 billion) in 2020, the highest in recent years.

In 2020, Hong Kong’s FDI assets increased by 3.2 percent, after experiencing a decrease of2.3 percent in 2019. This reflects the city’s restored strength as a major investor in other economies of the world.

On the other side, however, Hong Kong’s FDI liabilities declined by 3.2 percent, showing the lasting impact of geopolitical tensions, combined with the COVID-19 pandemic, on its position as a major global investment destination.

But in the second quarter of 2021, Hong Kong’s FDI liabilities recorded long-awaited growth of 5.9 percent, putting the city back on track to attracting international investment.

Business leaders and participation

John Lee, vice chairman and head of Greater China for global banking at investment bank UBS, and Catherine Leung, co-founder, and partner at MizMaa Ventures, a venture capital firm that has close links with Israel’s tech startup scene, are both BHKF’s council members. They have a greater idea of what is required to enhance the city’s competitiveness and thriving factors.

Leung is also the chairperson of the Chamber of Hong Kong Listed Companies, whose membership includes 240 companies listed on the main board and Growth Enterprise Market board of the Hong Kong stock exchange.

Lee and Leung take charge of encouraging the recent policy statements, notably Chinese President Xi Jinping’s July 1 speech marking the 25th anniversary of the Hong Kong Special Administrative Region. It confirmed the city’s “distinctive status and advantages.”

Although, a wider vision and investment will allow Hong Kong to fly high and give it the power to face the challenges. Lee and Leung agree that there is nothing to stop the city’s eclipsing rivals to stand tall as Asia’s premier financial market and restore its status as a major global player.

Leung says, “Firstly, I think one needs to step back and take a view of Hong Kong’s role in the overall scheme of things, if you read the reports on President Xi’s July speech, I think it is very clear that China needs Hong Kong.”

“The more China wants to have quality, sustainable growth, employment for all, and a good environment, with the country really laying its part as a global citizen and being self-sufficient in technology, the more important Hong Kong is for all of that.”

- Published By Team Hongkong Journalist