Factory activity has now hit its lowest level as a result of China’s decision to stop its Zero-Covid policy in December. The nation’s economic recovery is beginning to falter. Despite a possible agreement reached by US President Joe Biden and House Speaker Kevin McCarthy to lift the US debt ceiling, Asian markets collapsed after the release of May data. In terms of regional markets, Hong Kong’s stock index suffered the greatest loss on Wednesday and is on the edge of entering bear market territory, which is defined as a down of at least 20% from a recent peak.

The official manufacturing Purchasing Managers’ Index (PMI) for China decreased to 48.8 this month from 49.2 in April, according to statistics made public by the National Bureau of Statistics on Wednesday. The contraction has now occurred for two months in a row. A reading that is higher than 50 implies expansion, while one that is lower indicates contraction.

The PMI is currently at its lowest point since December, and it mostly measures larger businesses and state-owned enterprises. Early in that month, China has relaxed the majority of its pandemic restrictions, thereby ending its three-year Zero-Covid programme.

“The economic recovery faces challenge[s],” Zhiwei Zhang, president and chief economist for Pinpoint Asset Management, said Wednesday. “Domestic demand weakened recently, partly due to [the] cooling property market and the second wave of Covid.”

The property market in China, the second-largest economy in the world, is currently going through a substantial decline. The nation is also ready for a fresh round of Covid-19 infections.

According to renowned Chinese epidemiologist Zhong Nanshan, the second wave of Covid-19 infections, which is currently affecting people, will peak by the end of June, with over 65 million new cases being reported each week. State media has received assurances from Beijing doctors that the proportion of serious consequences and hospitalisation rates continue to be low.

There is a pessimistic attitude towards the economic outlook. Expert in the field Zhang made the observation that, particularly while the United States faces the possibility of a recession, foreign demand for Chinese goods is not assisting in the country’s economic recovery. Recent figures indicate a slowdown in global demand as it shows a fall in China’s export growth, increasing by only 8.5% in April compared to 14.8% in March.

“The sentiment in the financial market is quite bearish,” he said.

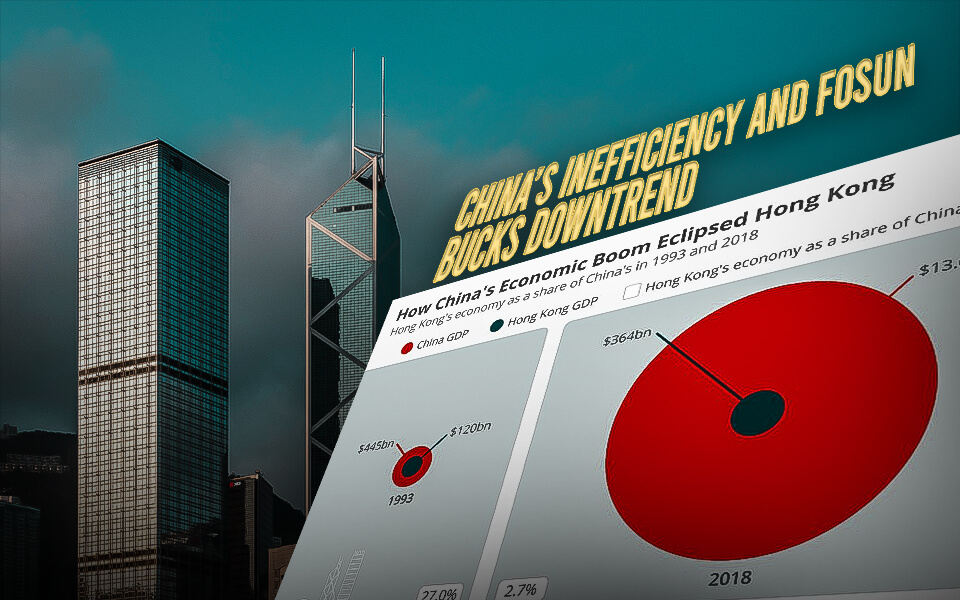

In response to China’s manufacturing and services report, Hong Kong stocks fell. During the afternoon session, the Hang Seng Index fell 2.4% and hit a six-month low. As of right now, it has decreased by more than 20% from its January 27 peak.

The Shanghai Composite Index in China fell by 0.6%, while the Nikkei 225 in Japan fell by 1.4%. The Kospi in South Korea originally indicated increases but ultimately fell by 0.3%.

Indicator of investor sentiment, the Chinese yuan, declined versus the US dollar. In contrast to the onshore rate, which fell by 0.4% versus the dollar, the offshore yuan traded at 7.126 per dollar, down 0.5%.

Last year, when pandemic limitations were abruptly lifted, China’s economy first displayed rapid expansion. GDP increased by 4.5% in the first quarter of this year compared to the same period last year, exceeding the 4% rise predicted by experts surveyed by Reuters.

Recent momentum, meanwhile, has slowed. April’s retail sales, industrial output, and investment all came in below economists’ expectations. An unexpected decline in the official manufacturing PMI last month ended a three-month record of sector expansion. A cooling off in the services sector was also seen in April.

Since consumer prices have not moved in recent months, worries about deflationary pressure have grown. Another key concern is the skyrocketing youth unemployment rate, which in April hit a record high of 20.4%.

- Published By Team Hongkong Journalist