Asian markets increased on Monday after Federal Reserve Chairman Jerome Powell said officials would proceed cautiously with interest rate increases, and Chinese shares advanced after the government reduced trade taxes.

The head of the US central bank left the door open to more tightening in a highly anticipated speech on Friday. Still, he reiterated his commitment that decision-making would be data-dependent as policymakers work to control inflation.

According to Powell’s remarks, borrowing costs will be held at a 22-year high of 5.25–5.5% the following month, but investors are still afraid that more increases could occur before the year is over.

Markets have been hammered recently by a solid run of economic data, notably with jobs, which have been perceived to be placing pressure on the Fed to keep increasing even though inflation is down.

“If the data continues to show an ease in labour market tightness and price pressures, then the Fed is likely done with its tightening cycle,” said National Australia Bank’s Rodrigo Catril.

“If the data doesn’t play ball, then further tightening should be expected. Thus, upcoming key market data releases (inflation and labour market) will likely set the tone for markets over the coming months.”

The comments initially caused US equities to decline, but they later recovered to close out Friday higher.

On Monday, Asia did the same, with solid starts to the week in Tokyo, Hong Kong, Shanghai, Sydney, Singapore, Seoul, Taipei, Jakarta, and Wellington.

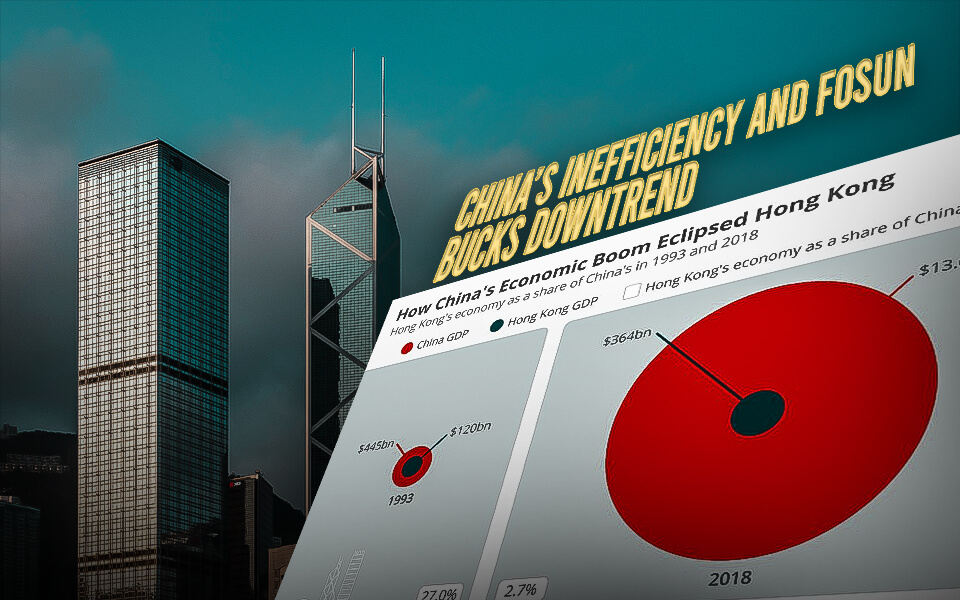

Following China’s move to reduce the tax paid on stock trading for the first time since 2008 as authorities fight to boost the world’s second-largest economy, Shanghai and Hong Kong jumped at the opening bell.

In a joint statement, the State Taxation Administration and the Ministry of Finance stated that the goal of the action was to “revive the capital market and increase investor confidence.”

Additionally, officials declared that they will reduce the number of new listings, which often drain market liquidity.

– ‘Positive signal’ from China –

The measures brought some relief to traders at a time when the government was attempting to revive the economy but a string of promises failed to inspire hope.

“The scale, force and speed of the measures all beat expectations,” said analysts at China International Capital Corp.

“The increasing force of the policy tools will lift market confidence, amplifying the positive signal for the market.”

Neo Wang of Evercore ISI, however, cautioned that equities weren’t likely to increase unless the government unveiled a substantial stimulus programme similar to the so-called “bazooka” in 2008.

Investors are also monitoring US Commerce Secretary Gina Raimondo’s discussions with Chinese counterparts as part of the most recent effort to reduce trade tensions between the two largest economies in the world.

The embattled Chinese real estate behemoth, Evergrande, has resumed trading in Hong Kong following a 17-month suspension due to the company’s failure to release its financial statements.

After finally releasing its earnings on Sunday, which showed losses of $4.53 billion in the first half of the year and only $556 million in cash assets, the company experienced a more than 80% decline in the morning.

Evergrande, formerly the biggest real estate company in China, went into default in 2021 and is now stuck with more than $300 billion in obligations.

A proposal from the developer addressing its offshore debt will be put to a vote by its creditors on Monday. This restructuring is expected to be one of the largest ever in China.

- Published By Team Hongkong Journalist