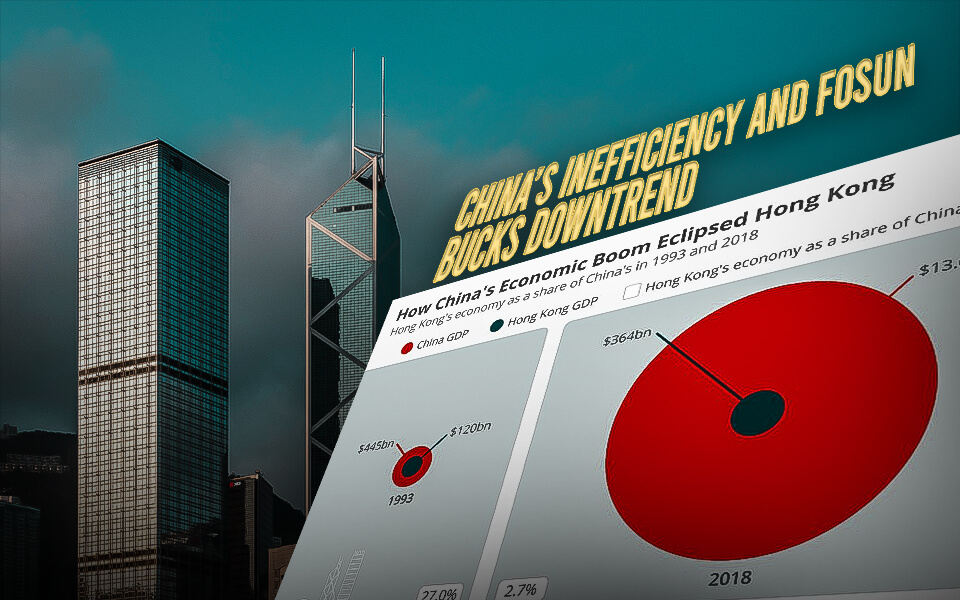

China expects 2023 to be the Year of the Tiger (A Chinese Horoscope). As a result, China has connected Hong Kong’s rapid stock improvement of a seven-month high on the last trading day to a renewed optimism that China’s growth will expedite after the wigwag to reopening of the economy.

The current stock indices show that Hang Seng gained 1% to 21,868.27 at noon break. It is said that they have reached the highest since June 29. The Hang Seng Tech Index advanced 1.6%, and the Shanghai Composite Index added 0.5%.

The giant brands and companies from China have also shown some improvement in their stocks, have a look.

| Company | Hike(%) | HK$ value |

|---|---|---|

| Alibaba Group Holding | 2.7% | 115.20 |

| Tencent Holdings | 1.5% | 388.60 |

| Baidu | 4% | 130.50 |

| CNOOC | 4.8% | 11.30 |

| PetroChina | 4.4% | 4.05 |

The buoyancy has been growing that China’s Covid-19 infections have already peaked after the sudden lifting of all pandemic restrictions last month. High-frequency data such as intra-city mobility and subway passenger volumes point to recovery from the Covid repercussions.

China aims to boost its appeal to foreign investors and continues developing the private sector; concerning veto, that the world’s second-largest economy will revert to a planned economy, Vice-Premier Liu He said in an interview with Phoenix TV in Zurich.

In a report by Morgan Stanely on Thursday, China’s retrieval may have already commenced in December, and the revival is likely to be more strengthened than expected. The US Investment Bank expects China’s growth to precipitate to 5.7% this year from 3% in 2022.

The Hang Seng Index has enhanced by approximately 50% from a 13-year low seen on October 31, as China dropped its rigid zero-covid policy and signaled an end to the crackdown on big tech platforms. Still, the benchmark has dropped 8% in the Year of Tiger, which started on February 1.

HSBC Jintrust Fund Management, in its 2023 strategy report, stated that “Stocks may see some back and forth in the first quarter after a significant rebound in the fourth quarter.” Further added, “But we’ll start to see a secure path to economic recovery and an end to the US interest-rate increases in the second quarter. That’ll speed up the pace by lifting earnings forecasts and boosting valuations.”

Meanwhile, Huaibei GreenGold Industry Investment nosedived 40% to HK$ 1.15 on the first day of trading in Hong Kong.

- Published By Team Hongkong Journalist