Due to anticipated higher profitability in the second half of 2023, Fitch Ratings has changed its outlook for the Hong Kong banking sector from “neutral” to “improving.” Strong net interest income, increasing fee income, and declining credit costs—all of which are anticipated to propel double-digit profit growth for the industry in 2023—support the updated view.

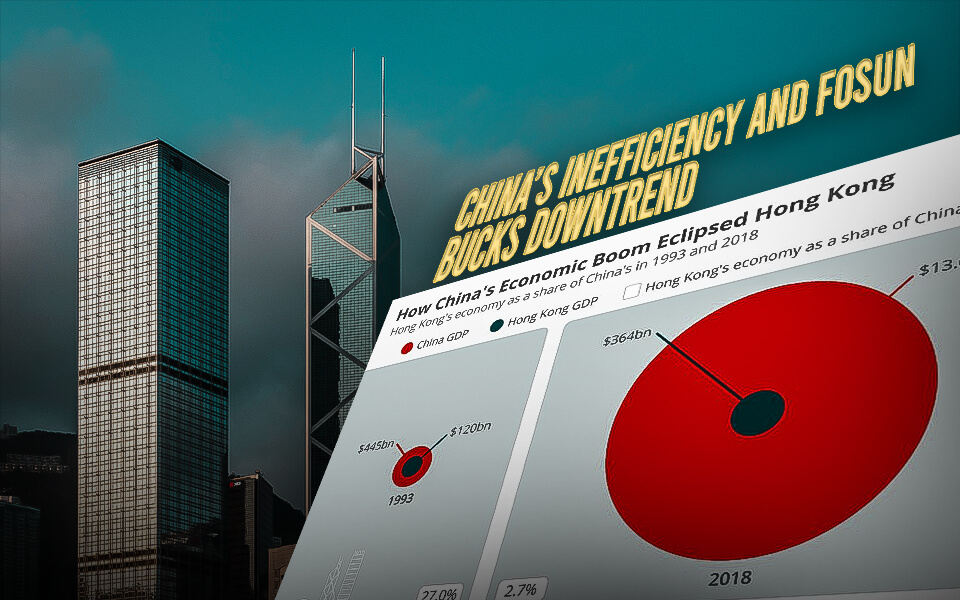

Following the reopening of the border, the ongoing economic recovery in Hong Kong and mainland China is expected to support the continued growth in business volumes for Hong Kong banks. In the city, the economy is anticipated to pick up steam, especially in the second half of 2023.

Increased local social activities and a spike in visitors from mainland China are fueling the rebound; these factors will increase consumption over the next quarters. Strong retail sales was the main factor in Hong Kong’s first-quarter 2023 GDP growth rate of 2.7%, which ended four consecutive quarters of loss.

Fitch anticipates that as economic activity picks up, bank loan growth in Hong Kong will resume. However, the uncertainty in the world economy may slow down growth. It is anticipated that the stabilisation of the Hong Kong real estate market, which will see a 5% year-over-year increase in the property price index in the first quarter of 2023, after a 15% decline in 2022, will boost sentiment and increase demand for mortgage loans. The loan balance for the banking industry increased by 0.9% in the first quarter of 2023, following a 3% decline in 2022.

In 2023, banks should be able to maintain a healthy level of net interest revenue, thanks to higher interest rates.

The banks are anticipated to create a greater average net interest margin (NIM) in 2023 compared to 2022, benefiting from the full-year impact of repricing loans at higher rates. The quarterly net interest margin (NIM) is believed to have peaked in the fourth quarter of 2022.

Thanks to governmental actions in mainland China intended to cut borrowing costs for the real economy and improve refinancing options for struggling developers, credit rates for Hong Kong banks in 2023 are anticipated to be lower than in 2022. It is also anticipated that recent efforts by Hong Kong banks to decrease sensitive exposures and increase reserves for probable credit losses will limit future deterioration.

However, as troubled Chinese developers continue to restructure their debt, the impaired loan percentages are anticipated to stay high in the foreseeable future. In the past few years, rated Hong Kong banks have faced considerable impairment costs as a result of syndicated loans to China’s real estate sector.

Even with the ongoing interest rate increases in the Hong Kong dollar, banks are still expected to have stable asset quality for their remaining loan portfolios. This prediction is supported by the city’s predicted 2024 economic expansion, low unemployment rates, strict underwriting guidelines, and government assistance for small and medium-sized businesses (SMEs) and other vulnerable borrowers.

In the present year, the typical loan-to-value ratio for freshly issued residential mortgages has stayed constant at between 55% and 60%. In addition, as stated in the most recent budget, the Hong Kong government has extended its SME Financing Guarantee Scheme till the end of March 2024.

- Published By Team Hongkong Journalist