Here’s what Hong Kong’s economy is experiencing;

- HKMA bought HK$4.22 billion and sold an equivalent amount of US dollars, strengthening their exchange rate and keeping the currency within the confines of its trading band.

- Earlier this month, the Federal Reserve increased the key US rate by 25-basis points, with Hong Kong’s intervention followed by it.

After another US rate rise led by the Federal Reserve at the beginning of this month and the capital outflow caused by it, Hong Kong’s central bank stepped into the forex market for the first time this year, in an attempt at protecting the currency peg to the US dollar.

The Hong Kong Monetary Authority (HKMA) purchased HK$4.22 billion, approximately US$538 million, and sold an equal amount of US dollars on Monday in New York, to keep the local currency rate in its trading band after it fell to HK$7.8500 against the US currency this week.

The trading band that has been in place since 2005 enables the HK$ to shift anywhere from HK$7.7500 to HK$7.8500 in exchange for the US dollar.

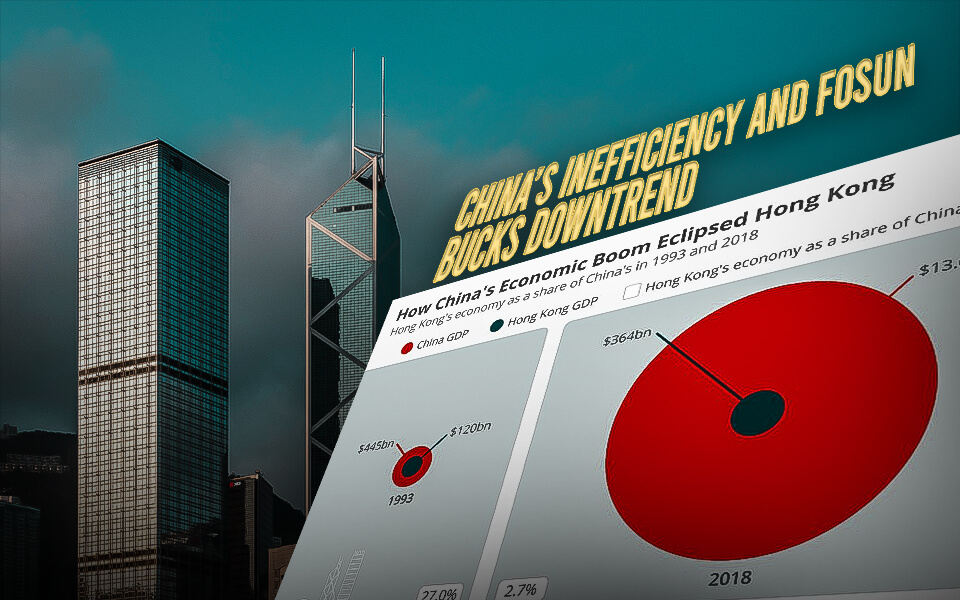

The Hong Kong currency fell because of the widening interest rate difference of more than 200 basis points as of February 9 between the US and Hong Kong, which was nearly at parity back in November.

While the one-month US dollar Libor (London Interbank Offered Rate) was at 4.58%, the one-month Hibor (Hong Kong Interbank Offered Rate) mitigated to 2.32% by February 9.

Kirk Wong, a global market and forex strategist at Everbright Securities International, said, “The exchange rate did not rise suddenly, but started to rise slowly from December, which means that speculative activity is not widespread.”

The HKMA intervention was staged after the US Fed’s 25-basis point rise in interest rates that took place on February 2, Hong Kong time. Any differences between interest rates for the US dollar and the Hong Kong dollar bring in arbitrageurs’ carry trades, impacting the economy with capital outflows in the city and devaluation pressure on the local currency.

Forex traders benefit from such price fluctuations and differences by selling a depreciating currency—Hong Kong in this scenario—while buying a promising currency like the US dollar. The increasing selling of Hong Kong dollars impels its exchange rate to weaken its trading band, gradually pushing the HKMA to intrude.

According to data given out by the HKMA, their recent intrusion will decrease the aggregate balance, i.e., the total balances maintained for clearing accounts managed by banks with the monetary authority, by around HK$4.22 billion to HK$91.86 billion on Feb. 15.

Luckily for Hong Kong, it has the backing of one of the world’s largest monetary war chests through the Exchange Fund. This fund is utilized to protect the local currency, which has been held down by the US dollar since 1983.

The HKMA’s CEO, Eddie Yue Wai-man, said in the Legislative Council meeting on Monday that, “Despite the heavy loss last year, the Exchange Fund still has a size of over HK$4 trillion, which can support the local currency and maintain the peg.”

“The public do not need to worry about the Exchange Fund’s losses – they should take a long-term view of the investment.”

Fed rate hikes since March last year have driven a huge capital outflow from Hong Kong. It has induced the HKMA to step in 41 times throughout 2022, buying HK$242.08 billion to steady the local dollar and revive it within its trading band. The previous intervention was on November 8.

A lawmaker representing the city’s financial sector, Robert Lee Wai-wang, said that “Some investors may be selling Hong Kong dollars and buying other assets.”

He added, “However, the situation should not cause any alarm. Any measures that the HKMA adopts should bring the Hong Kong dollar exchange rate to within the normal trading band.”

- Published By Team Hongkong Journalist