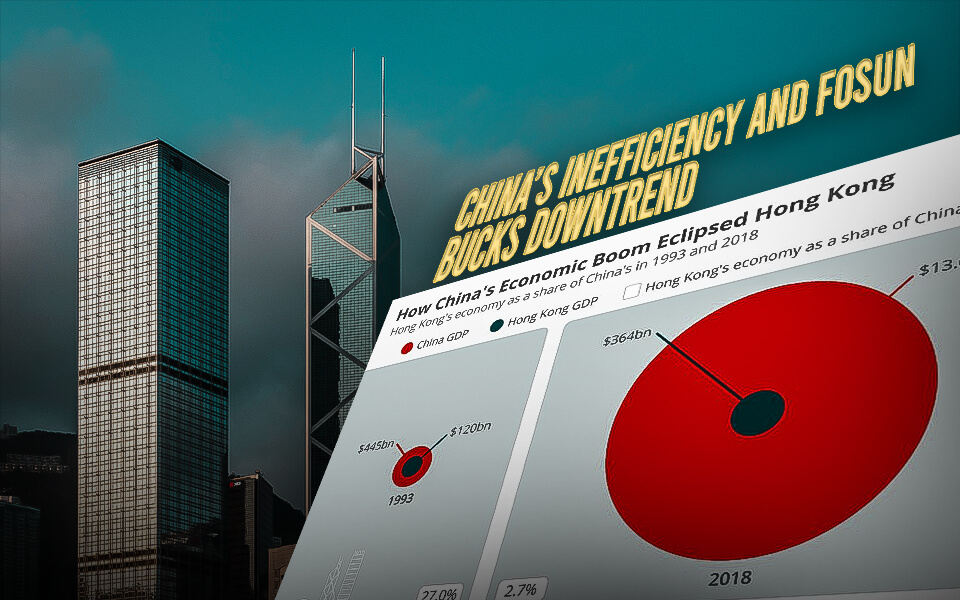

Beijing:- Some Chinese firms that made it through a year of travel bans and Covid lockdowns experienced growth online and abroad.

Economists predict China’s GDP will expand by only 3% in 2022. In addition, lockdowns hindered investors’ ability to evaluate agreements and inhibited business. As a result, the United States’ fundamental way of earning investment returns—the path to an IPO—basically came to a standstill.

Preqin, a VC data firm, predicts that venture capital funding for businesses in China and worldwide will continue to be weak for the next one to two years. Data from Preqin as of December 28 shows that the U.S. dollars funded by China-focused VCs fell by more than 80% from 2021 to less than $9 billion in 2022.

However, several transactions continued to take place in China’s information technology sector and areas connected to manufacturing and business connection apps, according to Angela Lai, a senior research analyst at Preqin.

According to her, venture capitalists have “dry powder,” or close to record funds, on hand. As of March 2022, according to Preqin statistics, China-focused VCs have $104.7 billion.

When the market improves, asset managers are prepared to act, according to Lai. So everyone’s watching to see when there will be a very nice entry point and when the macro will start to pick up.

Here are five companies’ predictions for their performance in 2022, listed in alphabetical order, as China prepares for a reopening from zero-Covid:

Anxinsec Technology

A firm founded in 2019, backed by Hillhouse Capital and BlueRun Ventures, has its headquarters in Beijing.

According to founder Alex Jiang, the income of cybersecurity startup Anxinsec quadrupled in 2022 to tens of millions of yuan. He mentioned Siemens, JD.com, and Baidu as recent examples of large corporations now his customers.

Requests for comment from the three businesses should have been promptly entertained.

Because it could supply its products online, Jiang said the business was able to reduce the impact of China’s Covid lockdowns significantly. However, he continued by pointing out that as more enterprises employ digital tools, such as ride-hailing applications and video conferences, the necessity for cybersecurity protection would increase.

According to Jiang, Anxinsec focuses on providing free services for personal use that secure data or memory. He noted that Microsoft said memory-related flaws account for 70% of vulnerabilities.

According to Jiang, the firm already has companies in Hong Kong and the United Arab Emirates, but it still has a long way to go before going public.

Ciarra

A firm founded in 2016, backed by Skyline Venture, has its headquarters in Foshan.

According to founder Kang Zuotian, sales of the European kitchen appliance firm Ciarra increased by around 25% in a year marked by inflation and conflict.

He asserted that sales might have increased by roughly 60% if the conflict in Ukraine had not started, but since energy costs grew faster than earnings, European customers’ desire to spend shrank.

With list pricing of a few hundred euros apiece or a few hundred dollars for the U.S. market, the firm produces cooker hoods and induction hobs for use at home.

Kang stated in Mandarin, which CNBC translated, that Ciarra devices utilize half the power of comparable products on the market, although 30% to 40% more expensive. “We don’t want Chinese firms to do business abroad just because it’s inexpensive.”

According to him, most goods are sent to Europe and mainly sold through brick-and-mortar businesses. Kang stated that he intends to use 2022’s financial results as a guide as he prepares for a mainland China IPO soon.

Keenon Robotics

A firm founded in 2010, backed by Prosperity7 Venture and Yunqi Partners, has its headquarters in Shanghai.

According to COO Wan Bin, Keenon Robotics witnessed a revenue increase of more than 40% despite no real growth expected in China for 2022.

According to Wan, the business launched operations in Tokyo, Seoul, Germany, Dubai, Los Angeles, and Hong Kong in 2022 as part of an aggressive push into foreign markets. He stated that the goal is to leverage China’s recovery in 2023 and use such locations to build a regional business.

Previously, Wan claimed that Keenon had seen revenue growth of at least double or more per year from a lower base throughout the expansion of the China market.

With a worth of more than $1 billion, Keenon has attained unicorn status. SoftBank Robotics and Keenon announced cooperation in September 2021, with $200 million in Series D funding led by SoftBank’s Vision Fund 2.

According to Wan, Keenon took around five years to focus on service robots, particularly those used in catering. As a result, they now have robots that carry packages to hotel rooms or serve food at establishments like Haidilao Hot Pot.

Wan said pricing is higher outside of China, where clients monthly pay roughly 2,000 Yuan per robot.

Regarding intentions for an IPO, Wan declined to provide information.

Povison

A firm founded in 2020, backed by eWTP Capital and Skyline Venture, has its headquarters in Guangzhou.

According to Povison’s creator, Ayden Lin, revenues more than doubled in the previous year and are expected to reach $50 million or more in 2022. He plans to go public in three years.

The company’s website, which has $2,000 marble dining tables, $1,500 sets of wooden cosmetics vanities, and $500 for a pair of velvet adjustable bar stools, is where most of the company’s sales are made to Americans. In Los Angeles and the southern Chinese province of Guangdong, the firm employs 100 workers, according to Lin.

According to Lin, he started working in China’s household furniture e-commerce sector in 2017. The industry, he discovered, was overproduced, but the suppliers needed to learn how to change their operations.

With the help of its 40 to 50 suppliers, Povison can swiftly identify areas of customer demand, according to Lin, who attributes some of his success to the company’s development of digital systems.

According to Lin, one system oversees storage facilities and separates the production process into phases so that operations like painting and gluing may be completed concurrently. The second links shipments with vehicles that can transport goods in the United States, he claimed.

Volant Aerotech

A firm founded in 2021, backed by Future Capital, Shunwei Capital, and Ventech China, has its headquarters in Shanghai.

China’s first passenger aircraft, the Comac C919, received national certification in 2022. In less than a year, engineers who worked on the aircraft started their own company, Volant Aerotech, to create an electric-powered helicopter.

Due to its technological expertise, Volant is better able to construct aircraft quickly and in a way that can satisfy regulatory criteria, such as those about the flight over water, according to founder and CEO Dong Ming.

A test flight of the Volant prototype has already been approved for early 2023 by China’s aviation authorities.

According to Dong, the vehicle may be utilized for shuttle services, charter flights, tourism, and package delivery, and deliveries are anticipated to start in the second half of 2026. He predicts that around 100 of the cars will have been delivered by Volant by the end of 2027.

Startups creating electric vertical take-off and landing (eVTOL) aircraft have received funding from Delta Air Lines and other commercial airline carriers.

- Published By Team Hongkong Journalist